Not known Details About Clark Wealth Partners

Table of ContentsAll about Clark Wealth PartnersUnknown Facts About Clark Wealth PartnersNot known Factual Statements About Clark Wealth Partners The Buzz on Clark Wealth PartnersClark Wealth Partners Things To Know Before You BuyExcitement About Clark Wealth PartnersNot known Details About Clark Wealth Partners Clark Wealth Partners for Dummies

Common reasons to take into consideration an economic consultant are: If your financial scenario has become more complex, or you do not have self-confidence in your money-managing skills. Conserving or browsing major life events like marriage, separation, children, inheritance, or task change that may considerably impact your monetary scenario. Browsing the shift from saving for retired life to protecting wide range during retired life and exactly how to produce a strong retired life earnings plan.New innovation has actually resulted in even more comprehensive automated monetary tools, like robo-advisors. It's up to you to explore and determine the right fit - https://fliphtml5.com/homepage/clrkwlthprtnr/blanca-rush/. Ultimately, an excellent financial advisor needs to be as mindful of your investments as they are with their very own, avoiding extreme costs, saving money on taxes, and being as clear as feasible regarding your gains and losses

3 Easy Facts About Clark Wealth Partners Explained

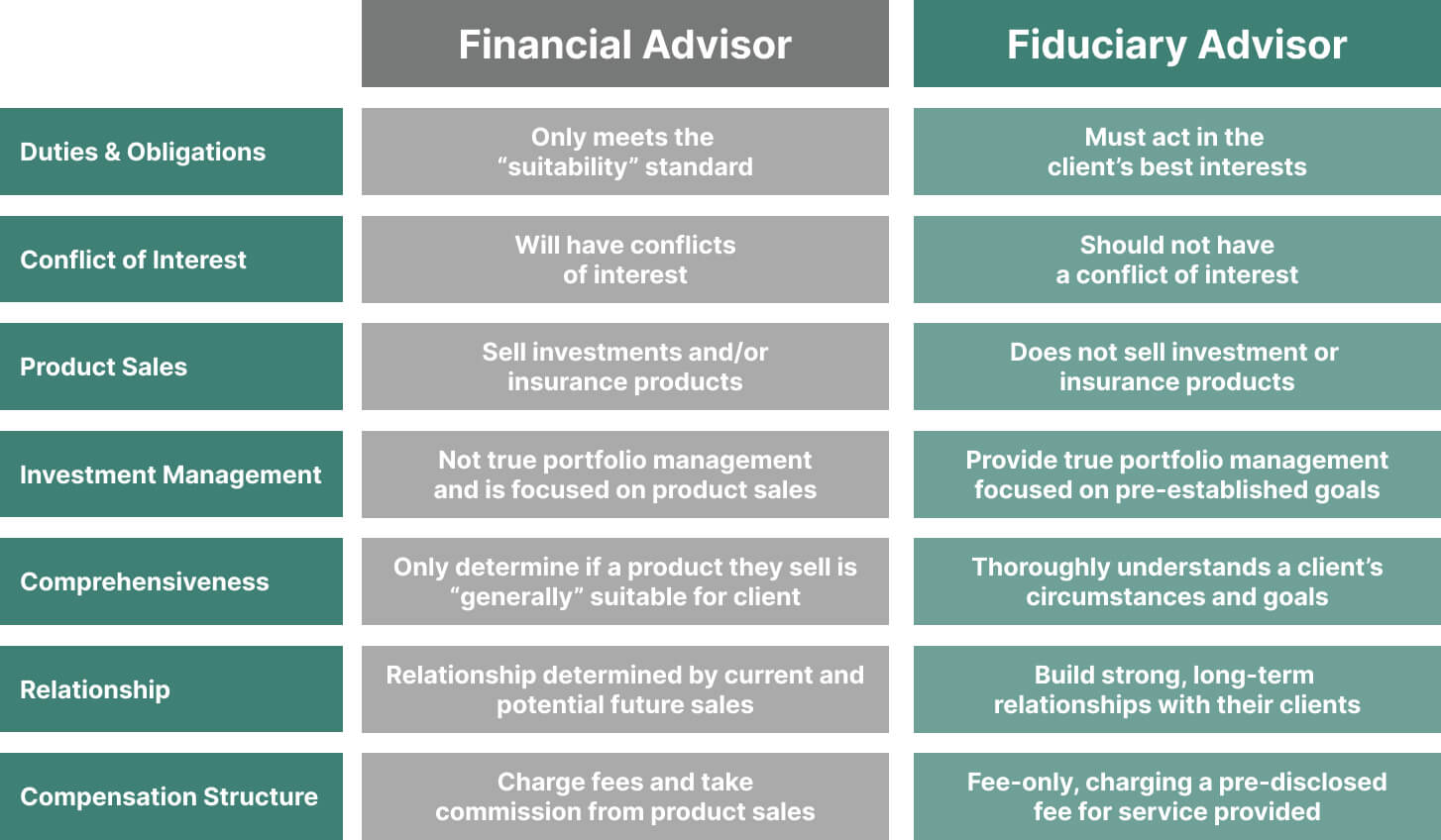

Making a payment on item suggestions does not necessarily indicate your fee-based consultant works against your benefits. However they might be extra inclined to suggest services and products on which they earn a commission, which may or may not remain in your best rate of interest. A fiduciary is legally bound to place their client's passions initially.

This typical enables them to make referrals for financial investments and solutions as long as they match their client's objectives, threat tolerance, and financial situation. On the various other hand, fiduciary consultants are legally bound to act in their customer's ideal interest rather than their very own.

Not known Facts About Clark Wealth Partners

ExperienceTessa reported on all points spending deep-diving right into complicated economic subjects, clarifying lesser-known investment avenues, and revealing methods viewers can function the system to their benefit. As an individual money professional in her 20s, Tessa is really aware of the influences time and uncertainty have on your financial investment decisions.

It was a targeted ad, and it functioned. Review more Check out less.

Not known Facts About Clark Wealth Partners

There's no single course to ending up being one, with some people beginning in banking or insurance, while others start in bookkeeping. A four-year level provides a strong foundation for careers in investments, budgeting, and client solutions.

All About Clark Wealth Partners

Common instances consist of the FINRA Series 7 and Collection 65 examinations for safeties, or a state-issued insurance policy license for marketing life or medical insurance. While qualifications may not be legitimately required for all planning duties, employers and customers usually view them as a benchmark of professionalism and reliability. We look at optional qualifications in the next section.

The majority of look at here monetary organizers have 1-3 years of experience and experience with economic products, conformity requirements, and direct customer interaction. A solid educational background is necessary, but experience demonstrates the capability to apply concept in real-world setups. Some programs integrate both, enabling you to complete coursework while earning monitored hours through internships and practicums.

The Buzz on Clark Wealth Partners

Several get in the field after functioning in financial, accounting, or insurance policy, and the shift calls for perseverance, networking, and usually innovative credentials. Very early years can bring long hours, stress to construct a customer base, and the demand to continuously verify your knowledge. Still, the profession supplies strong long-term capacity. Financial coordinators take pleasure in the possibility to function carefully with clients, overview important life choices, and commonly achieve versatility in timetables or self-employment.

Wide range supervisors can increase their revenues via commissions, property fees, and performance bonus offers. Economic managers oversee a group of financial planners and advisers, setting departmental approach, managing compliance, budgeting, and guiding interior operations. They spent much less time on the client-facing side of the industry. Almost all monetary supervisors hold a bachelor's level, and several have an MBA or comparable academic degree.

Everything about Clark Wealth Partners

Optional qualifications, such as the CFP, typically call for additional coursework and screening, which can expand the timeline by a number of years. According to the Bureau of Labor Statistics, personal monetary experts make a median yearly annual wage of $102,140, with top income earners earning over $239,000.

In other provinces, there are laws that require them to fulfill certain needs to utilize the monetary consultant or economic organizer titles (financial planner in ofallon illinois). What establishes some monetary experts besides others are education, training, experience and qualifications. There are lots of classifications for financial experts. For financial planners, there are 3 usual designations: Licensed, Individual and Registered Financial Coordinator.

The Best Strategy To Use For Clark Wealth Partners

Where to find an economic advisor will certainly depend on the type of recommendations you require. These establishments have personnel who may assist you understand and buy particular types of investments.